A fast, easy, reliable way to process certain personnel and payroll actions; such as changes to taxes, financial allotments, direct deposit, address, Thrift Savings Plan, and Health Benefits.

How to Access Employee Express

If you are an existing Employee Express user, your account will be deactivated if you do not log into your account within 60 days of your last login. If your account has been deactivated or locked, submit a help request by clicking on “Submit Help Request” in the top right-hand corner of the Employee Express website. Fill in the requested information and click the Submit button.

If you are a new employee, your personnel action is completed by your Servicing Personnel Office (SPO). The following day, Employee Express issues a welcome letter. If a work email address is entered at the time the action is completed, the welcome letter is sent to the work email address. If the work email address field is left blank, the welcome letter is sent by postal mail(note: employees will receive the letter within 2-4 weeks, depending on when the personnel action is completed in in the Federal Personnel and Payroll System (FPPS). The welcome letter contains a security code and a link that the employee can click on or enter in their web browser. Once in the link, the employee is asked to enter the 12-digit security code from the welcome letter, and additional identifying information. The security code is valid for 30 days from the date on the welcome letter.

Employees have the option to change many types of personal transactions at the Employee Express (EEX) web site. Employees may change tax information, addresses, direct deposit information, allotments, Thrift/Roth Savings Plan elections, Thrift/Roth Catch-up elections, and Federal Employee's Health Benefits.

The effective date of a transaction initiated in EEX will be based on the type of transaction, when it is initiated, and whether the employee is starting or stopping an action. The following guidance is provided to help employees understand what effective dates will be used for a transaction, when it will appear as completed in EEX, and when it will be evident on the Leave and Earnings Statement.

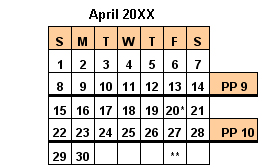

For ease of explanation, the following calendar will be used:

*LES for pay period 20XX09, ending April 14th is received.

**LES for pay period 20XX10, ending April 28th is received.

General Rules for Payroll Transactions:

The payroll calculation process occurs on Tuesday or Wednesday after the end of a pay period, and uses whatever information is in the system with an effective date falling in that pay period. For example, a transaction with an effective date falling from April 1 through April 14 will be used in the calculation for pay period 20XX09.

Exception: Most voluntary deductions, including allotments, Thrift/Roth and Thrift/Roth Catch-up with a stop date on the last day of the pay period will still be deducted for the pay period in which the stop date occurs.

EEX sends accepted transactions to IBC daily (Monday through Friday) with a 3:00 am (Eastern Time) cut-off. IBC loads those files after 6:00 pm on the day of receipt. Therefore, a transaction submitted in EEX on one business day will be transmitted to IBC on the next business day, and will be loaded into FPPS that evening.

How are effective dates for Employee Express Transactions determined?

Transactions for addresses, direct deposit information, allotments or taxes will be sent to FPPS with the effective date it was input in EEX. If requested, a confirmation to the user indicates when the transaction is accepted in EEX.

| Example 1: | An address change input to EEX on April 13 will be effective for pay period 20XX09. |

|---|---|

| Example 2: | A change to direct deposit information input on April 16 will be effective in pay period 20XX10, even though pay for pay period 20XX09 has not yet been calculated. |

Thrift/Roth or Thrift/Roth Catch-up deductions will have an effective date of the first day of the pay period after it was input. This means there will be one more deduction for the pay period in which it was input before a stop request takes effect.Example 3:A new Thrift/Roth Catch-up deduction authorized on April 2 will be effective beginning April 15, with the first deduction occurring for pay period 20XX10.Example 4:A stop of a Thrift deduction which is input on April 2 will result in a deduction for pay period 20XX09, and no deduction for pay period 20XX10.

Health Benefits changes made during the open season period will be effective the first full pay period in the calendar year.Example 5:A health benefits open season change made December 20, 20XX, will be effective January 6, 20XX.

Health Benefits changes made as a result of a Qualifying Life event will be effective the first day of the next pay period.

When can the employee see in EEX that the change has been processed in FPPS?

Although EEX sends a file to FPPS daily (except Saturdays and Sundays), FPPS sends an updated file back to EEX only once per pay period, after the payroll calculate process has run. If the transaction was effective for the pay period just completed, it will be evident in EEX the same day that Leave and Earnings Statements are available in EEX for that pay period.

When will the employee see the change on their Leave and Earnings Statement?

If the transaction was effective for the pay period just completed, it will be evident on the LES for that pay period. If it will be effective the following pay period, the LES for the following pay period will show the change.

What if multiple transactions are processed the same pay period?

If multiple transactions are initiated for the same item, the most recent transaction will be used in processing for the current pay period.

| Example 3: | An employee changes their tax record on April 11, and again on April 12, 16, and 18. The last change made on April 12 will be effective in pay period 20XX09. The last change made on April 18 will be effective in the following pay period, 20XX10. |

|---|

Below is a table to summarize the information above.

| Transaction Changes | Effective Date in FPPS | Type of action | Impact in FPPS |

|---|---|---|---|

| Address, Taxes, Allotments, Direct Deposit | Date action was initiated in EEX | Starts, stops, changes | Effective this pay period |

| TSP, TSP Catch Up Roth, Roth Catch Up | 1st day of next pay period | Start, change | Deduction taken next pay period |

| Stop | Deduction taken this pay period, stops next pay period | ||

| FEHB Open Season | 1st full pay period in year | Change | Deduction taken first full pay period of the year; no change until then |

| Stop | Deduction taken until the first full pay period of the year, then it stops | ||

| FEHB Life Qualifying Event | 1st day of next pay period | Start, change | Deduction taken next pay period |

| Stop | Deduction taken this pay period, stops next pay period |

Go to our FAQs page and select “Employee Express”.

Visit our Training page to access Employee Express Training.

Employee Express Help Desk

In the top right-hand corner of any Employee Express page, click “Submit Help Request” and fill-in the requested information.